When is Republic Day?

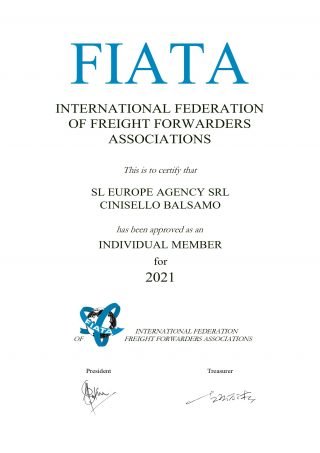

SL Europe, freight forwarder inform , always celebrated on June 2nd. This is Italy’s National Day.

Republic Day (Italian: Festa della Repubblica) marks the referendum of 1946, which resulted in the creation of the Italian republic.

History of Republic Day

Italy became a nation on March 17th 1861, when most of the states of the region and the two Sicilies were united under King Victor Emmanuel II, hitherto king of Sardinia.

The father of Italian unification was Count Camillo Benso di Cavour, the Chief Minister of Victor Emmanuel.

Rome stayed under the rule of the Papacy for nearly 10 years and became part of the Kingdom of Italy on September 20th 1870. This is the final date of Italian unification.

On June 2nd 1946, a referendum on the monarchy led to the establishment of the Italian republic, and Italy adopted a new constitution on January 1st 1948. Male members of the royal family were sent into exile because of their association with the fascist regime and were only allowed to return to their country in 2002.

Italy’s constitution now forbids a monarchy to ever rule again

In 1977, the national holiday was moved to the first Sunday in June, for economic reasons to avoid the holiday having a negative effect on working hours. It stayed on the Sunday until 1999, when June 2nd was made the official date.